Cattle market is at record levels.

The drought is not over, and neither is the wet season.

2 February 2016

By Roger Hill (Director) Herron Todd White North Queensland

It is premature to make a generalized ‘blanket call’ that there will be an increase in rural property values this year.

Independent and informed stakeholders would know that while the various commodities prices of sugar, beef, bananas and horticultural produce is one part of the equation, the operating cost and capital structures of each enterprise tier vary and so too to the property sub market segments within each industry.

To simply say that there is to be a boom across the board this year would indicate scant regard for the effects of seasonal conditions, negativity around debt issues, choice to herd build (where rain has fallen) or trade stock at current prices and interest rates.

Season

The wet season so far has seen good, frequent falls of rain between Normanton, Julia Creek and Cloncurry (western side of the region).

The drought is not over, and neither is the wet season.

At this stage the eastern band from Charters Towers up through Greenvale to parts of the Georgetown district (eastern side) has just started to receive some rain.

Synoptic charts are showing the development of the monsoonal trough. The bureau website rainfall scenario outlook models for the next three months indicate bellow median to median falls.

Perhaps, those in the less fortunate areas so far will get some of the rain from the monsoonal trough.

Some of the bureau forecast maps suggest that the rain pattern may do an about turn, with a change to less in the west (where the rain has fallen) and more in the east.

Where the rain has fallen, graziers are choosing to hold cattle from the boats to allow weights to increase ready for sale.

For these graziers, this is one of the first times that this opportunity has existed since 2012! In 2013, the north was forced into one corner – sell!

There is no doubt that in some areas, it is going to take more than one wet season for the country to recover.

Commodity Prices

By now everyone will have heard that the cattle market is at record levels. There was a small dip in prices prior to Christmas, however boat activity has commenced out of Townsville for the year and southern sale yards have opened up.

Southern cattle market reports have been positive.

In some districts (where rain has fallen), graziers are electing to hold cattle while they put on weight. This is good for the north.

Enquiry for cattle has increased from traders and restockers.

Talk remains focused on the Indonesian market demand and political issues.

Vietnam is now a major market and while China is revising its GPD growth forecasts, these markets offer a good hedge for cattle marketing options from North Australia.

Of note, is that there are some political and market issues arising. These are both domestic and international. These are possibly the preliminary signs that the commodity is starting to get expensive in those markets.

Normally there is a seasonal dip in the market as the first round of mustering commences from March to May/June. In 2013 this dip was substantial as the effects of the drought kicked in and cattle had to be sold. Now, it would appear that this dip may be minimal this year due to the continued strong demand.

Bananas have been trading well this year. As usual, February and March can be volatile months as this is the traditional cyclone period.

Sugar prices appear to trading between US14.5 to US15 cents per pound. There is some positive speculation regarding the price of sugar for the year ahead. Brazil has nearly finished harvesting.

It is quite possible that with the stronger US dollar, that the Brazilians will produce more ethanol than sugar this year and therefore possibly maintain the sugar price at current levels. As far as our farmers are concerned, with the low Australian dollar, a small increase in the US price of Sugar will result in a strong farm gate Australian dollar price rise!

Farmers this year will no doubt focus on production. Currency cross rates will determine the farm gate price in Australian Dollars.

Input Costs Fuel and energy costs remain a big issue in the rural sector.

The electricity costs of pumping water for livestock or irrigation and powering packing sheds (for horticultural enterprises) continues to thwart business operating costs.

This is not just a problem for the on farm sector. Agricultural support businesses are also enduring this issue.

The low oil price is positive at present.

Labour costs have levelled out in recent years, as a result of the contraction of the mining sector, the availability of labour is increasing.

Lick supplement costs have been roughly level for the last three years. Most of the ingredients are produced domestically and therefore have not been greatly affected by the movement in the Australian Dollar. It is expected that current lick supplement costs will remain as they are in the year ahead.

Cotton Seed has become expensive. This is understandable as the graziers have been sourcing as much as they can to feed to cattle. Some of these loads are coming from as far afield as southern New South Wales.

Capital markets

Interest rates remain low. This is a key attribute of any business owner and at current pricing, is a positive feature for the rural industry.

The current cash rate is 2% which is down from 4.75% in 2011.

With inflation at current low levels, changes to interest rates in the immediate term, appear minimal.

This is a major feature that the beef cattle industry in particular is seeking to benefit from.

Property markets

Sugar cane and horticultural property sales are low sale volume markets. There has been little variation in value rates in recent years, and at this stage with stable commodity pricing and operating costs, there is no real reason for change.

Cattle station markets have higher sale volumes than their coastal agricultural counterparts.

In 2015 a healthy number of twenty five (25) cattle station sales were recorded across the north. Sale volumes have recovered from a low of about fourteen (14) in 2009.

This is a positive sign for the property cycle.

The corporate market sentiment has benefited from the exposure of the marketing of the Kidman Portfolio, also the sales of Wollogorang and Walhallow Stations in the Northern Territory. While none of these stations (including the Kidman Portfolio) are in North or North West Queensland, the exposure has been of benefit to the investment grade sector in the global marketplace.

At this stage there are no new settled corporate sales to report on that indicates any market value movement.

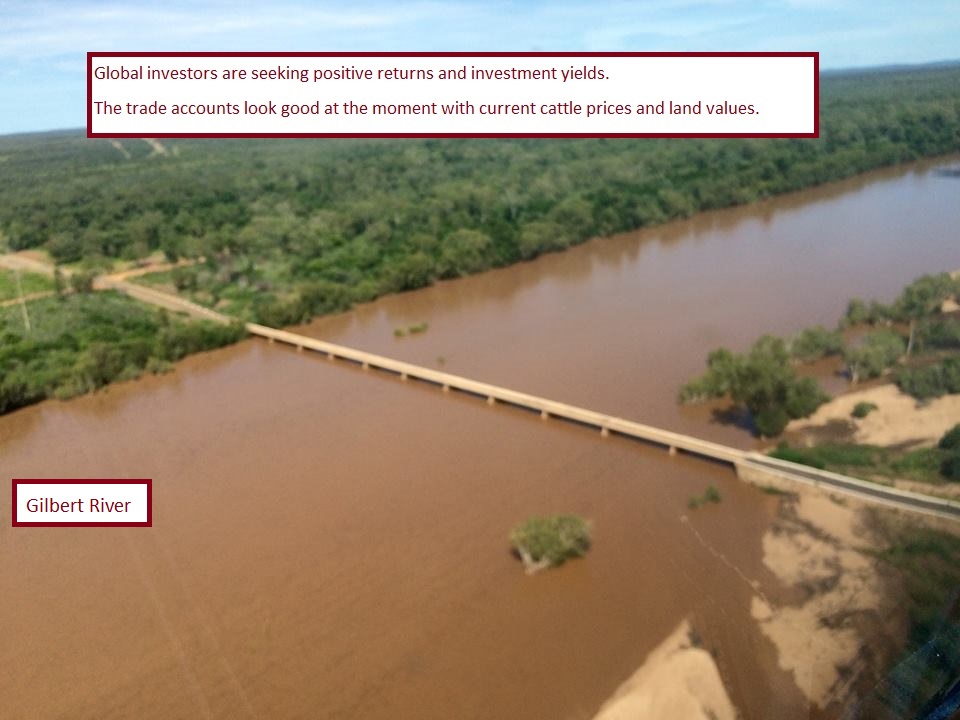

Global investors are seeking positive returns and investment yields. The trade accounts look good at the moment with current cattle prices and land values.

It will be interesting to see if market sales do start to show an increase in values at all.

The reason is, over the years, investors often are heard saying ‘why would you invest in agriculture when the yields are so low’?

Now that the cattle market is strong, the percentage passing yields (relationship between income and value) have increased their spread. Should new sales show a rise in the value of the land, then the percentage yields will compress again!!

In the mid-scale, family market, the focus has been on surviving the drought. Unlike the corporate market, many families do not have other stations with grass to spread cattle numbers out.

Some of the family enterprises (that have had rain) are looking to hold heifers to re stock rather than buy them back in.

This option will take two to three years rebuild; therefore it will take some time before those businesses look to buy another station (unless it comes with a good herd).

Given that the drought is not yet broken, there are family owned businesses that are still on survival mode and looking for a break in the season to eventuate.

There are also debt issues in this sector which are in the throws of being worked through.

This market segment is in a holding pattern while the debt issues are sorted out, the herds are rebuilt or the drought is endured.

At this stage, while there is positivity in the commodity markets and low interest rates being offset by seasonal impacts, herd rebuilding and debt issues, it would appear that sale volumes will be similar to last year and limited change in values of grazing lands as the recovery /consolidation phase is endured.

All enquires phone Roger

Roger Hill – 0418 200 046