NQ Month in Review

What Price should Northern Water be?

NQ Month in Review

Roger Hill Valuer (Director) at Herron Todd White

Water for northern industry development – What Price should Northern Water be?

Industry stakeholders have all voiced their welcoming of Minister Anthony Lynam’s recent announcement of the release of 92,500 megalitres of water in the Flinders and Gilbert River systems.

This round of allocations is proposed to be at a fixed price! That is good too, isn’t it? Well, perhaps!

What price per megalitre is going to hit the nail on the head for northern agricultural industry development this time?

Has there been any mention of tradability? Or will these allocations be tied to the parcel?

What development covenants or policies are going to complement the price so that collectively, Government and industry can look back in ten years time and say, ‘we did get it right that time’?

These are simplistic questions, but they need to be addressed by all stakeholders!

Remember, this has to be a win win for Government, landholders, local towns/communities and investment partners (be they equity investors or debt raised through the banking sector).

Pricing:

There are various methods to determine the price. These should all be considered independently in such an immature and developing market area.

There are both ‘bottom up’ and ‘top down’ methods to calculating what price the water. Independent advice should be sought to ensure that the water price modelling is appropriate.

There is some relevant market history in the local area. Careful consideration is required to contemplate the price discussion with the result:

1. The first round of allocations for the Flinders and Gilbert River averaged $36/megalitre.

The result: industry was unhappy with the division of allocations occurred. Government was unhappy that none of the allocations were utilised and local communities missed out on any economic benefit;

2. Second round of allocations saw Government implement more structure to the distribution via reaches. To force industry to use the allocations, the minimum bid of $46/megalitre model was introduced.

The result: Limited successful tenders, lots of talk, no benefit to communities and no projects developed;

3. In 2016 there was an opportunity for graziers to purchase Great Artesian Basin Sustainability Initiative (GABSI) allocations which were to be attached to their bore supply. The price was fixed at $1,430 per megalitre.

The result: Government said there was low demand due to only a small uptake. Industry buyers were scared off by the price. Industry commentary was that had the price been reasonable, then there would have definitely been more applications and acceptance of the offer documents.

These three examples demonstrate the importance of the price relationship to covenant / allocation / policy design.

So, what broader market price parameters are relevant?

A quick survey of the Herron Todd White Independent Rural Valuer’s around Queensland yielded the following:

Southern Queensland:

• Current trading price range for high security water is $3 - $4,000 per megalitre. High priority (100% reliability) water across the Border Rivers and Gwydir River systems in Northern New South Wales where delivery infrastructure is in place and the water is used for irrigating intensive agricultural and orchard type crops.

• Majority of water trading in this area is medium priority or supplementary (water harvesting).

• Medium priority water has water delivery infrastructure in place (landowner owned). This includes pumps, supply channels and dams. Medium priority water is used for broad scale irrigation (eg cotton). This water is trading from $1,750 to $2,200 per megalitre and peaking around St George to $2,500 per megalitre.

• The lowest priority water is from water harvesting. In New South Wales this is called Supplementary, in Queensland this is called Unsupplemented water. These allocations use the same, farmer owned delivery infrastructure as for the Medium priority allocations.

• In Queensland, the Unsupplemented Water (Condamine and Balonne Rivers), these allocations form the highest volume of market trades. These allocations trade for about $1,300 to $1,700/meg in Qld and a slight discount in New South Wales.

Key points to consider here:

1. Mature water trading market;

2. Established high Gross Margin industries;

3. Established knowledge capital on how to grow high Gross Margin crops;

4. Development finance and capital not required as the scheme is established;

5. Established financial relationships with experience with water/irrigation returns on investment risk parameters so that debt funding and equity instruments can be written;

6. Infrastructure is developed and is working – there is no development risk;

7. The free market scarcity (demand) has driven the water price to these ranges;

8. The towns and communities have developed a workforce, service centre and infrastructure to support the surrounding industries.

Central Queensland:

• Medium priority sales are ranging from $1,700 to $1,900 / megalitre;

• High priority sales are few and far between and peaking to $2,500/megalitre.

The above points regarding industry maturity, high Gross Margin crops, developed infrastructure and communities are relevant again.

North and Far North Queensland:

• Atherton Tablelands water is trading at an all time high of up to $3,000 per megalitre due to the scarcity of water. This scarcity arises not just due to the drought, but also due to the cropping area expansions being such that crop demand is much higher than the allocated water.

• Burdekin. Limited trades at all. There is no scarcity. This is an immature trading market. The irrigated production areas are the same size as they were when the allocations were detached from the land titles so there is no increase in demand above the allocations that farmers already have. Reported value apportionments in sale contracts of farm, water, plant, crop is reported to range from $50 to $70 and sometimes $90/megalitre.

The previous points regarding industry maturity, high Gross Margin crops, developed infrastructure and communities are relevant again.

Further development Considerations:

The initiative to develop a project must also provide adequate return to the investor/farmer/grazier developer and financier.

In time, the broader goal is for high Gross Margin crops; however the first ‘incubator’ irrigation sector is the fodder crops for hay/silage.

You might recall that in 2012/13, hay was in short supply and was being trucked from southern districts. Hay farmers in North and North West Queensland that year experienced peak demand and high Gross Margins.

As soon as it rained late last year and when cattle numbers reduced, the contrary situation existed. There was limited demand and of course, no Gross Margins (possibly even a loss).

It is evident that the Gross Margin volatility is an economic issue – not all is smooth sailing and this is a risk that the industry has been worried about.

Bearing in mind the three local market instances of pricing mentioned earlier and the broader established market information: The question arises as to what price can be afforded for the water given the value of the land underneath the farm site, the investment in earth works, water works and seed to create a crop?

Investment decisions require prudent consideration of a profit/value return for the effort and risk taken to develop a project.

Why would an investor (in this case, a grazier/farmer, banker/investor) inject capital in such a project if there was no capital value return?

There is an opportunity cost and a rate of return required to make such a development decision to evolve the business model to incorporate the farming activity and potentially create employment within the wider community.

A recent exercise with one of our trading type grazing clients identified that for the highest and best use of the grazing land to be better and put to a farm project, the hurdle rate of return had to be greater than 15% off tight Mitchell Grass Downs.

From an urban development perspective, 15% is likened to a basic subdivision project, not the development of a farming block harvesting water from the Flinders River or Gilbert River!

This hurdle rate of return has been used in the following straight line ‘back of the envelope’ development model example. You might choose to use a higher risk to represent that of the seasonality of water harvesting.

There is sales evidence in the North and North West Queensland rural property market where the added value of fodder crop farming areas range from:

• $2,500/ha (this was a mortgagee sale of a western block; that was not in production; the soil required re working; had an empty earth storage tank and is exposed to the seasonality of gulf river harvesting); to

• $8,500/ha for an area under centre pivot on a larger cattle station (in use; established to Rhodes Grass farm; pumping from a year round reliable river source).

If one of these projects were to be developed on a downs grazing block then perhaps the added value rate might be $5,000/ha once established in this example.

Further considerations:

• Planting cost - $300/ha;

• Development cost – removing the Mitchell grass, laser levelling, constructing bays, and laying pipelines from the bore. Roughly $3,000/ha.

• Grazing land sales suggests the underlying grazing land rate of $300/ha ($120/acre).

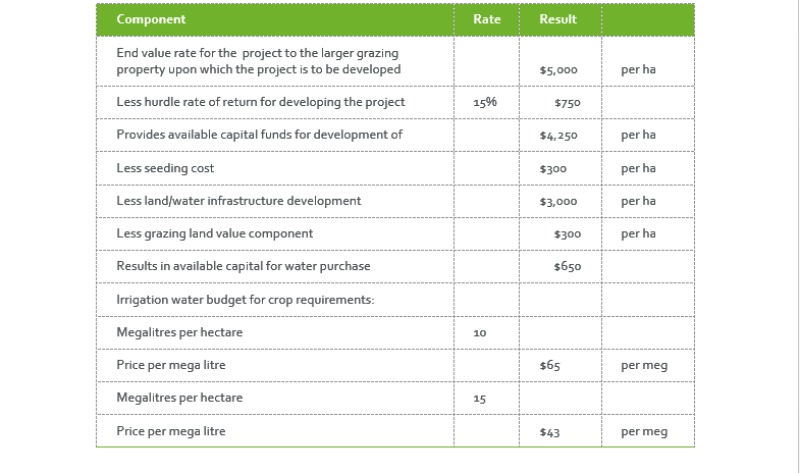

The following model (demonstration purposes only – not a valuation, so use your own inputs especially if you are proposing higher Gross Margin crops) applies these variables to provide industry with a calculation model to determine how much capital is available for the acquisition of the water.

This example model provides only one example of pricing methodology at a low risk, low return rate of 15%. Pricing in a higher risk would lower the available capital to spend on the water.

The larger scale operators will employ the use of Discounted Cashflow Analysis (DCF) to give dynamics to the timing of each stage of the respective projected capital expenditure and the expected cash inflows.

The interesting point here is this basic, back of the envelope model provides a similar range to the previous pricing of the first and second rounds of allocation tenders.

Perhaps the covenants and policy need to be collaborative to actually make good use of this opportunity.

Collectively, what do you think is relevant to ensuring a win win and so that in ten years time, industry and communities have grown positively?

Should co investment by Government in infrastructure be explored perhaps?

What about financial structure around the purchasing of the allocations? Debt may not be available from existing channels to acquire the allocations and then to construct the farming project.

Perhaps the financing of the allocations can be on a progressive payment basis. You might be aware that this has happened before in the form of Freeholding Leases.

Perhaps the ballot system, similar to that of the Brigalow Scheme would be worth re visiting!

Through collaboration with the investors/financiers, the structure of the allocation payment scheme may help to finance the project development.

Is there any reason why access to development funding cannot be sourced or co-secured by the Government?

It is noted that the Government sought to implement an initiative to force the use of allocations in the second round. Perhaps a requirement for the allocation funding agreement and structure would result in a time frame for development and use of the allocation.

As industry stakeholders have stated: This is a good opportunity, yes. However a collaborative approach will be required to address stakeholder’s needs so that this announcement does in fact materialise into being a winner for North Queensland.

NQ Month in Review

There are about ten contracts of sale in the marketplace at present

Roger Hill Valuer (Director) at Herron Todd White

The unseasonal rain this year has presented similar effects to the NQ grazing property market with an unusual number of sale contracts and negotiations under way for this time of the year.

There are about ten contracts of sale in the marketplace at present. This is usually the dry season which corresponds to a low number of property transactions.

The normal marketing / selling period is after the wet from April to June. This year saw limited market activity during this period and things were looking bleak.

Now that some rain has fallen in winter, things have stepped up a gear and total sale volumes for the year are expected to be within a healthy range from 20 to 25 cattle stations.

Many of the details of transactions are confidential at this stage.

From an independent view point, the sale prices are sensible when duly considered and do not reflect an increase in values from last year.

There are some areas where sale value rates this year are showing that they have recovered to the pre drought levels. They are certainly not above the pre drought levels though.

Yes, the volumes have recovered from the slow start earlier this year. No there is not some great tide of purchasers running around in a frenzy!

Purchasers are getting enough time to do their due diligence and negotiate reasonably priced deals.

Up until recently, the strong cattle market has been good for vendors and has enabled businesses to do some good cattle trades and re generate cashflow after three very lean years.

This has enabled some prospective vendors to pay their bills while they market their station.Perhaps with the cattle market coming off a bit lately, property buyers will remain cautious in their due diligence.

Apart from the rain, a good thing for the property market is the low interest rate environment! This would be attractive for some buyers and also positive for existing owners.

At this stage, the recovery in values to pre drought levels is looking good for the district to the north of Richmond, Julia Creek, Cloncurry and Camooweal up to the Gulf. The other area that is showing signs of value rate recovery is from Hughenden to Muttaburra and back up to Prairie.

NQ Month in Review

What is your water worth?

Roger Hill Valuer (Director) at Herron Todd White

Of late, I have had many discussions with clients regarding what price should be paid for the water from the GABSI bores in order to establish irrigation projects.

Just as the land and its development is a key capital contribution, so too is the price that is paid for the water.

If you can apply the following land value concept, the same appears to apply to the value of water:

‘Land in itself has no value, it’s the use to which it is put is from where it derives its worth’ (Source: A.F. Millington)

The purpose of these small area bore irrigation projects is to act as a drought mitigation fodder farm with the opportunity of a small amount of off farm income.

There is a possibility of higher use and higher Gross Margin crops, however the first priority is drought mitigation.

You might recall that only last year, hay was in short supply and was being trucked from southern districts.

Hay farmers in North and North West Queensland last year enjoyed peak demand and high Gross Margins.

This year, the contrary situation exists following recent rain events and the reduced cattle heard. There is limited demand and of course, no Gross Margins (possibly even a loss).

Due to the Gross Margin volatility, there are GABSI bore type hay farmers who are researching their options at present. These include:

- To either slow down their crop cycles (limit the fertilising and water inputs to widen the gap between cuttings),

- Buying the equipment and plastic to silage wrap to conserve the fodder,

- Build storage sheds;

- Or incorporate a cash crop rotation to provide crop diversity.

Either way, it is evident that the Gross Margin volatility is an economic issue.

The question arises as to what price can be afforded for the GABSI water given the value of the land underneath the farm, the investment in earth works, water works and seed to create a crop?

Investment decisions require prudent consideration of a profit/value return for the effort and risk taken to develop a project.

Why would an investor (in this case, a grazier/farmer) invest in such a project if there was no capital value return? Yes, the farming project provides a drought mitigation strategy! However, there is an opportunity cost and a rate of return required to make such a development decision to evolve the business model to incorporate the farming activity and potentially create employment.

A recent exercise with one of our trading type grazing clients identified that for the highest and best use of the grazing land to be better put to a farm project, the hurdle rate had to be greater than 15% off tight Mitchell Grass Downs.

From an urban development perspective, 15% is likened to a basic subdivision project, not the development of a farming block!

Taking on board the intention of these small projects being a drought mitigation tool and not the key focus on the enterprise, this hurdle rate of return has been used in the following straight line development model.

There is sales evidence in the North and North West Queensland rural property market where the added value of fodder crop farming areas range from:

• $2,500/ha (mortgagee sale of a western block, that was not in use, the soil required re working, it had a large, dry earth storage tank and is exposed to the seasonality of gulf river harvesting); to

• $8,500/ha for an area under centre pivot on a larger cattle station (in use, established to Rhodes Grass, pumping from a year round, reliable river source).

If one of these drought mitigation hay projects were to be developed on a downs grazing block then perhaps the added value rate might be $5,000/ha once established.

- Further considerations:

- Planting cost - $300/ha;

- Development cost – removing the Mitchell grass, laser levelling, constructing bays, and laying pipelines from the bore. Roughly $3,000/ha.

- Grazing land sales suggests the underlying grazing land rate of $300/ha ($120/acre).

The following model (demonstration purposes only – not a valuation) applies these items to identify how much capital is available for the acquisition of the water for a GABSI project

| Component | Rate | Result | |

| Added value rate for the GABSI project to the larger grazing property upon which the project is to be developed | $5,000 | per ha | |

| Hurdle rate of return for developing the project | 15% | $750 | |

| Provides available capital funds for development | $4,250 | per ha | |

| Seeding cost | $300 | per ha | |

| Land/water infrastructure development | $3,000 | per ha | |

| Land component | $300 | per ha | |

| Available capital for water purchase | $650 | ||

| Water budget | |||

| Megalitres per hectare | 10 | ||

| Price per megalitre | $65 | per meg | |

| Megalitres per hectare | 15 | ||

| Price per megalitre | $43 | per meg |

A review of market water value rates is also of benefit to provide perspective:

Emerald:

- Higher gross margin pure cropping and horticultural enterprises;

- Water infrastructure to farm valve;

- Scarcity – there is market demand for water from other farmers who have insufficient water allocations;

- Tradeable water with investor activity creating a reasonable trading volume;

- Established market trading range of $1,400 to $1,600/Meg.

Burdekin:

- Higher gross margin pure cropping and horticultural enterprises;

- Water infrastructure to farm at a fee;

- Limited to no scarcity – current allocations were matched to crop requirements per farm prior to being detached from the land titles;

- Tradeable water, however due to limited scarcity, trades are rare;

- Hearsay values (due to limited scarcity and rare trade volumes) of $50 to $90/Meg.

Atherton Tablelands:

- Higher gross margin pure cropping and horticultural enterprises;

- Water infrastructure to farm valve;

- Scarcity – there is market demand for water from other farmers who have insufficient water allocations;

- Tradeable water with investor activity creating a reasonable trading volume;

- Established market trading range of $700 to $2,000/Meg.

Apparent free market factors include: Gross Margin (the use to which the water is put is from where it derives its worth) and scarcity (simple old ‘demand’ side pricing).

Locally, one of the market factors to consider is the first round of Flinders River allocations. These are a higher risk/cost development than a GABSI drought mitigation project.

The average price paid for this higher risk, more expensive water allocations was $36/meg. It is acknowledged that at this price, the allocations were ‘shelved’ for later use or divestment at this price.

The lowest bid price for the recent rounds was increased to $45/meg. This was not due to free market forces.

This was a cost increase to entice purchasers to use the allocations through an insinuation that the creation of trading reaches would increase localised demand and encourage small scale prospective farmers to establish projects.

The initiative to develop a project must also provide adequate return to the investor/farmer/grazier developer. Perhaps the quote should read: “Land and Water in themselves have no value, the uses to which they are put is from where they derive their worth”

NQ Month in Review (July)

1 July 2016

Roger Hill Valuer (Director) at Herron Todd White

Rainfall in the last month has certainly been a boom for the cattlemen!

Unseasonal rain in early June has turned the cattle market northward again!! Prior to the rain, the cattle market was following its normal seasonal trend of softening from April to June. Since the rain, demand at the Charters Towers saleyard and private demand through agents has seen prices really hit their peak! This is good for those who have cattle to sell!

The sentiment of the cattle market has not transferred fully to the property market as yet. One could say that the market is experiencing a mixed bag of results.

There is good news of sales in country near Julia Creek, Richmond and Boulia. For some, the sale of Neumayer Valley between Julia Creek and Normanton has not gone without notice!!

This has been met by unsuccessful offerings of three stations to the north of Charters Towers (Wade, Maryvale and Newmoon), one block to the south of Julia Creek (Phenros) and a larger gulf station (Morella). The result of the Morella auction flies in the face of speculation or innuendos that just any Gulf station is subject to strong and booming demand!

The Gulf has many very good, world class stations, however not every station is the same.

It is fair to say that the domestic (local) graziers are vigilantly running the numbers. There are not a large number of local buyers that are ready to purchase a cattle station right now. There certainly are buyers doing the sums, but not a lot of deals are actually going to contract or settling.

There are other reasons that a station may sell to investor type buyers for what locally might be described as ‘strong money’. The local grazing market may not be aware of the buyer’s reasons for offering the money that they do.

From a global perspective, the reason of ‘capital protection’ is arising a lot. With the global economic uncertainty, the option of parking capital for a term, in a North Queensland cattle station is seen as one of the better options and strategies to protect or minimise the risk that the money is being (or likely to be) exposed to where it is presently invested.

In years gone by, Gold was seen as the best protection measure. When economic uncertainty prevailed, investors bought gold. We think the cattle price movement is exciting, gold has been strong too (as a defensive investment though).

Gold was about $1,060us/oz in December, as this year has moved on, uncertainty has increased and following the Brexit vote has now reached $1,330us/oz.

This is an example of how global investors are worried at present. Hence the interest in Australian Agricultural assets. Given the gold price movement, there is likely to be more.

It is apparent that when either preparing a station for sale or doing the due diligence to buy, one needs to consider if the property in question is of a class or type of station that will get up a gallop and appeal to an investor type buyer.

The market has demonstrated that if the type of station is not one that would appeal to the investment buyer, then it will meet the scrutiny of local graziers who are really doing their sums!!

Sugar

Sugar is another commodity that is doing well this year. It is not often that the sugar price is up at the same time cattle is. There is an old saying about this: that ‘when the beef is good, sugar is not so sweet!

Despite the apparent strength of the sugar price, operating costs are very high and the current spot price has not transpired in to contracts in Australian dollars in the hands of farmers.

Current value rates in the Burdekin do not appear to have changed much in the recent year or so. There have been a steady number of transactions from $9,500/hectare to $16,000/ha overall (including buildings).

There has been the odd sale just over this range, however not too many as the better classed country does not sell too often.

Roger Hill Valuer (Director) at Herron Todd White

Over the last three years there has been a re-emergence of leasing of grazing country in North Queensland. With the cattle market trading as it is, this is not a surprise!

There are articles appearing in the press from time to time saying ‘That it’s the way of the future’ and ‘that’s how land and grazing business ownership is structured overseas’.

There are investors seeking to get exposure to the property value cycle. This is not just because they are betting that the property cycle is about to go up, but also to protect their capital against inflation and investment risk exposure elsewhere in their portfolio.

From a grazier’s point of view, there is a benefit of leasing country to expand their cattle business without having to buy the property. Agisting country does not provide the tenure security, so leasing may be an option.

While these points are mooted, discussion about leasing structures and rents are required.

Understandably, the rental yield (%) return rate and details creating the structure vary from property to property.

The current yield range is certainly not as wide as it was in the last property cycle. In the current market, there are rent ranges of between 3.75% and 7%.

There is a larger variation in the lease terms and conditions that make the deal. Some of these noted recently, include:

1. Who (tenant or landlord) does the water runs, checks the fences;

2. Who does (and pays for) the mustering;

3. What and who does any weed control;

4. Who has occupancy of the buildings;

5. How often a landlord can inspect a property;

6. The term (years) of the lease and any option periods.

It is quite obvious from the list above that while the rental rate range might not be too big a range, yet the detail of who does what in the deal is where the variation is.

One of the things that was incorporated into some leases in the last property cycle was that of how much of the rent was diverted into capital development, this can often deliver the operator better operational gains as well as enhance to overall asset for the owner/investor.

It is prudent to have legal advice as to the drafting and checking of a proposed lease, there are other factors that sometimes get over looked. One of these, is simply: 3.75% to 7% of what? A lease structure that is a function of the longer term production capacity (profitability and business scale) versus just the land value.

Would be a better alignment to the ongoing capacity to pay the lease, after all that is the objective for both parties to make a return on the investment.

What value should the rental yield rate be applied to? While it sounds obvious that the value of the property is the answer, it is noted that sometimes the perception of the property value has not been derived by an independent source or event (sale price).

The result is that the lease agreement may be legal, but has the value or the rent been established or verified by an independent source?

This is not overlooked by commercial property investors for shopping centres or landlords of motels/pubs of similar capital value as a cattle station!

Leasing a cattle station is not for everyone. It is certainly not every grazier’s cup of tea! There are some who have tried this previously and it has not worked. Some of these agreements are examples of unsustainable rental rates. Prudent, professional and independent advice is required.

In recent times there are a small number of stations that are being leased and to date, these agreements appear to be working.

There are a couple (and not limited to) of considerations that could possibly be of benefit to grazing lease agreements, which may be:

1. Control over stocking rates for the benefit of land condition and seasonal variation – perhaps a mechanism could be incorporated for times of extreme seasons (drought or abnormally good seasons) so that the rent for those years changes accordingly. This would have a twofold benefit, one is that in a drought the tenant is not subjected to rent pressure and can look after the county.

If a land lord is going to give that rent reprieve benefit to a tenant, then perhaps for a sustainable relationship, in very good years (certain rainfall patterns and pasture budget) then the rent could be increased for that year.

2. Rent review mechanisms – Many commercial tenancy agreements have annual reviews to the Brisbane Consumer Price Index (CPI) throughout the term of the lease, then at the commencement of the option period, an independent market review occurs.

The cattle market does have variations. Cost inputs to the grazing business vary from time to time as well.

There are periods of grazing business growth that would outstrip that of the Brisbane CPI. As everyone knows, there are many cycles in the bush, where Brisbane CPI cost increases would be far ahead of any business growth (or contractions)!

Prudent rent review mechanisms are seen as a good tool to sustainable tenant / landlord relationships.

From the existing land owner’s point of view, the option of leasing their station out is positive from many viewpoints. Examples of these might include:

• The perception of a low risk passive and regular income stream;

• For the benefit of succession planning within a family;

• Asset protection measures;

• As an exit strategy.

There are many reasons for the investor, grazier and existing station owner to research and consider leasing.

As pointed out in this article, prudent, professional and independent advice is required. At this stage of the property cycle, many graziers may be tempted to take on these structures as a way to move forward to address debt, family or investment concerns.

The first question then for the grazier is does the requested least rate equal the average returns from owning the property. If the return year in year out is less than this lease request, what is the benefit to a sale and lease back for a grazier? Being clear what is affordable and then using other contract options to negotiate a sound agreement that is mutually beneficial is the challenge.

While the cattle market is strong, this may attract investors and leasing options will arise. Prudency and good governance is required.

NQ Month in Review (April)

Roger Hill Valuer (Director) at Herron Todd White

Season

The lack of cyclone activity and timing of the rain that has fallen this year certainly points to the fact that the drought is not over and this should not be taken lightly. February was dry and there were no cyclones to fill the gaps.

Naturally, the rain that fell in the forest country has been good. Grass response on the softer to light forest country types has been good. Cattle have been held back off the market to put on condition. These should start to come on the market shortly.

With first round starting now, the calves and weaners are in far better condition than their older brothers and sisters of the last couple of years. Despite this, hopefully there is enough grass for their mothers to maintain condition and cycle this year! And this is of concern! There is a risk that later this year there could well be a lack of feed.

In some districts, the grass that grew from the January rain was haying off through February and then when the March rain fell, it ruined that grass. There has been some grass grow back in these areas after the March rain, but this does not mean that the March rain added to the ‘grass bank’.

The districts to the north of Julia Creek and Cloncurry and north to the Gulf of Carpentaria did get benefit from the March rain where the Mitchell grass was still growing. This country is having a good year after the December, January rains kicked the season off!

The country to the south of Julia Creek did get some good falls, however in some instances this has not resulted in grass at all!

Charters Towers has had some good falls here and there. Rainfall recorded at the airport is about 60% of the median. The basalt country to the north and North West has had some good falls with the grass still growing well for those who have managed their country through the last run of dry years.

Grazing Property market

From a property market perspective, the March rain has been good for the presentation of Maryvale which is being offered on a destocked basis to market via auction on 11th May in Townsville. This auction marks the start of the 2016 marketing period for the region.

Last year was a good selling season for the stations to the south of Charters Towers Regional Council area with seven sales which were as follows:

| Property | Size (ha) | $/ha bare | $/acre bare |

| Binkar | 25,300.00 | $73 | $30 |

| Broadleigh Downs | 12,872.30 | $233 | $94 |

| Bettsvale | 5257.63 | $285 | $115 |

| Devon Park | 6288.00 | $350 | $142 |

| Mount Hope | 20,322.00 | $369 | $149 |

| Liontown | 14,900.00 | $470 | $190 |

| Barkla | 3870.00 | $543 | $220 |

The last station with any Basalt influence that sold was Newburgh while in for $60/ha in December 2012 during the drought.

The well-known station, Toomba sold in June 2012 for $158/ha (including about one third of unusable basalt wall).

Given the way the season has gone, there area to the north of Julia Creek / Cloncurry and north to the Gulf of Carpentaria is where confident market enquiry and offers to purchase is likely to be this year. The good season and cattle market confidence are positive drivers to enquiry in that region.

Neumayer Valley is in the Gulf district and is back on the market having sold in 2012. It will be interesting to see how this sale proceeds and at what price. The property has enjoyed a better wet season than most in North Queensland.

Month in review March

Roger Hill

The Australia Day weekend is a good indicator of how the season is to pan out. This year, it was a dry weekend. For those in the Charters Towers area: rain did not interfere with the Goldfield Ashes cricket weekend!

Where rain has fallen the rain gauges have recorded from 30% to 50% of median for the time of year.

There is speculation that it may rain in April (towards the end of the growing season). For forest country graziers, any rain is good rain. For those with downs country, this could spoil their feed quality if the grass has hayed off.

Some good falls have been received to the north of Julia Creek, Cloncurry, Chillagoe, Normanton,

Georgetown and Charters Towers. These falls are not wide spread. For instance, there are some areas around Georgetown that have had a good storm or two, while the Croydon area has not been so lucky.

For those with cattle in hand, their calves are heavy and cows have a good body score ready for the

season ahead.

For those with reduced numbers, agistment options may arise in these areas this year. Also, this might present opportunities for some grassed blocks to be offered for sale. Rent the grass or sell the station: that is the question?

The area from say Winton to Kynuna/McKinlay and up to Julia Creek has had a very patchy season.

In some paddocks, one side can be dry and the other have an abundance of fresh green curly, hoop and bull mitchell with button grass.

An interesting thing that I have noticed about where the grass has grown is how much weed has come up.

Some areas have no weed, while the next might have a lot!

Earlier this season, good falls of rain fell to the south of Richmond and to the north of Julia Creek. The areas along the creeks is still green, however away from the creeks is starting to hay off. Any follow up rain from now on may spoil this good grass. Either way, it’s good to have the grass!!

This is the fourth year of tough, dry conditions. The drought is far from over and graziers have done very well to manage their way through and are working hard to keep stock alive. There are graziers who have been feeding a core herd on a daily basis for a long time now.

Decisions regarding the cattle selling programmes for the year have been met with strong cattle prices.

Some clients have already sold their cattle for the year.

There are some managers who are going to take a risk on waiting until Easter until they start the selling programme. The thought process here is that prices are holding up despite the works in Townsville being shut (at the time of writing)!

Either way, the prices are up and this is a positive feature for this year’s budgets.

Just as varied as the seasons, so to will the property marketing programme for the year. At this stage

there are few forest stations being actively marketed. Given the ledge that the market is sitting on waiting to see how the season pans out, I do not expect to see many forest country listings for another month or two.

May and June could well see some well grassed breeding stations come up for sale. One of the marketable features of those stations at that point in time, will be how many breeders are on the station.

With cattle prices at these levels, the herd is a very valuable and attractive feature.

There are two or three grassed Downs blocks on the market at present.

Agents for those blocks are reporting moderate enquiry at this stage. Potential purchasers are waiting just in case their existing blocks receive rain in the next couple of weeks.

There is interest increasing again in the larger northern stations. Investment vehicles (trusts and companies) are certainly doing their due diligence on available options in the north.

At this point in time, there are no large, investment grade stations being publicly marketed in the north. It is not often that one is. Blue ribbon investment grade station stations have been thinly traded for some years now.

The due diligence and private negotiations are on ‘Green ribbon’ stations. The interest in ‘Green ribbon’ type investment grade stations is expected to continue throughout this year while cattle prices are good and their financial returns are attractive to this type of potential buyer.

It is positive to see this activity in this market segment.