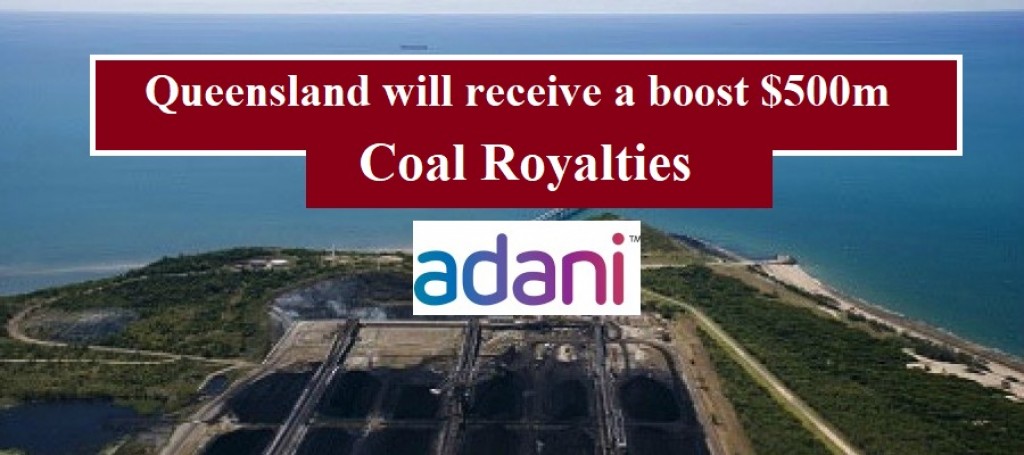

A surge in international coal prices.

Expected to help deliver an extra $500 million in royalties into Queensland's coffers this financial year

ADANI MINING (UP DATED)

A surge in international coal prices is expected to help deliver an extra $500 million in royalties into Queensland's coffers this financial year, providing a much-needed fillip to the cash-strapped Palaszczuk government.

Despite the lukewarm response of the state Labor government to new coal projects in the frontier Galilee Basin, including Adani's controversial $2 billion Carmichael mine, the resurgent resources sector will help Treasurer Jackie Trad deliver a stronger set of numbers in the midyear budget update on Thursday.

But the rest of the state's economy remains languishing behind its southern neighbours, with the Sunshine State still recording the highest unemployment rate in the country, with 6.3 per cent of the workforce unable to find a job.

Queensland Treasurer Jackie Trad will receive a boost from increased coal royalties.

There is also not expected to be much inroad made into the state's total debt, which is still predicted to top $83 billion by 2021-22.

Stronger prices for both metallurgical coal (used to make steel) and thermal coal (to burn in power stations) is expected to drive royalties over $5 billion for this financial year – and a few extra hundreds of millions over the forward estimates.

Queensland Resources Council chief executive Ian Macfarlane said the extra royalty boost could top $500 million and allow the Palaszczuk government to crank up its investment in services and infrastructure.

"QRC is confident this figure will now exceed $5 billion, which is good news for the Palaszczuk government and more importantly good news for all Queenslanders who will benefit through the government's increased capacity to invest in services and infrastructure," Mr Macfarlane said.

But Mr Macfarlane warned Ms Trad about resisting the urge to tinker with the state's royalty regime to take advantage of the resurgent coal sector and with LNG royalties finally starting to flow into government coffers.

"Our tiered structure for royalty taxes works well in Queensland and makes sure that the strength in the resources sector translates directly into benefits for all Queenslanders," he said.

"Abrupt changes to policy or tweaking the rates of royalty taxes will undermine the sector's ability to pay more, invest more, export more and ultimately pay more taxes."

Coal estimates

Queensland Treasury traditionally uses conservative assumptions when estimating coal royalties.

The royalty figures for the 2018-19 budget were based on $US161 per tonne for hard coking coal, $US128 a tonne for semi-soft and $US89 for thermal coal and an exchange rate of 75¢ against the US dollar.

All three types of coal have been delivering producers much higher pay days with metallurgical coal closer to $US200 a tonne, about $US130 for semi-soft coal and over $US100 for thermal coal.

While the return of the coal boom has helped deliver stronger returns, many in the sector have been dismayed by the lacklustre response of the Palaszczuk government to new projects in the Galilee Basin.

The Palaszczuk government did not welcome Adani's announcement earlier this month it would self-finance the Carmichael mine, merely noting no taxpayer money would go towards the project.

They also questioned whether Adani would be able to join Aurizon's Central Queensland coal network, even though it is a regulated asset and the rail company has no choice but to assess proposals to join the open access regime.

It is understood the Coordinator-General's decision to approve MacMine's $6.7 billion coal mine in the Galilee Basin was held up for weeks before it was finally released.

Adani and the development of the Galilee Basin is a sensitive subject for the Labor Party, especially for federal Labor leader Bill Shorten ahead of next year's federal election, due in May.

Queensland premier Annastacia Palaszczuk went cold on the Adani project during last year's state election campaign announcing it would veto any federal loan for the project – a move to help shore up Green preferences in inner-city seats.

Despite the strong resources sector, the Queensland economy has been flat in recent years.

Adani Mining’s Carmichael mine and rail project will be 100% financed through the Adani Group’s resources, Adani Mining CEO Lucas Dow announced in regional Queensland today.

The announcement was made to community leaders, mining industry contractors and suppliers at the Bowen Basin Mining Club luncheon in Mackay and follows recent changes to simplify construction and reduce the initial capital requirements for the Carmichael Project.

Adani Mining CEO Lucas Dow, said construction and operation of the mine will now begin.

“Our work in recent months has culminated in Adani Group’s approval of the revised project plan that de-risks the initial stage of the Carmichael mine and rail project by adopting a narrow gauge rail solution combined with a reduced ramp up volume for the mine,” Mr Dow said.

“This means we’ve minimized our execution risk and initial capital outlay. The sharpening of the mine plan has kept operating costs to a minimum and ensures the project remains within the first quartile of the global cost curve.

All coal produced in the initial ramp up phase will be consumed by the Adani Group’s captive requirements.

“We will now begin developing a smaller open cut mine comparable to many other Queensland coal mines and will ramp up production over time to 27.5mtpa,” Mr Dow said.

“The construction for the shorter narrow gauge rail line will also begin to match the production schedule.

“We have already invested $3.3 billion in Adani’s Australian businesses, which is a clear demonstration of our capacity to deliver a financing solution for the revised scope of the mine and rail project.

“The project stacks up both environmentally and financially.

“Today’s announcement removes any doubt as to the project stacking up financially.

“We will now deliver the jobs and business opportunities we have promised for North Queensland and Central Queensland, all without requiring a cent of Australian taxpayer dollars.

“In addition to providing these jobs in regional Queensland, our Carmichael coal will also provide a power source to improve living standards in developing countries.”

The Carmichael Project will deliver more than 1,500 direct jobs on the mine and rail projects during the initial ramp-up and construction phase and will support thousands more indirect jobs, all of which will benefit regional Queensland communities.

Preparatory works at the mine site are imminent and Adani Mining is working with regulators to finalise the remaining required management plans ahead of coal production, some of which have been subject to two years of state and federal government review.

This process is expected to be complete and provided by Government in the coming weeks.

Today’s announcement follows eight years of planning, securing approvals and successfully contesting legal challenges from anti-mining activists.

“We have worked tirelessly to clear the required hurdles,” Mr Dow said.

“Given we meet the same environmental standards and operate under the same regulations as other miners, we expect that Adani Mining will be treated no differently than any other Queensland mining company.”

Mr Dow said the people of North Queensland and Central Queensland had been steadfast in their support of the project from the beginning.

“We want to thank them for sticking with us,” Mr Dow said.

“Thanks to the people of Rockhampton, Townsville, Mackay, Bowen, the Isaac and Central Highlands regions. We look forward to delivering on our promise of creating jobs and helping local businesses and the communities thrive for many years to come.”

“We’re ready to start mining and deliver on our promises to Queensland.”

This is an important milestone that will help create new opportunities for trade and investment between Australia and India.

Posted in Jim Pola Blog on Thursday, 29 November 2018

Location

Townsville QLD 4812